These past few weeks, the business world has been turned upside down by a company once assumed to be close to the end of its lifetime- GameStop.

Last week, GameStop closed at a whopping $340/share. Only two weeks ago, GameStop was selling at $43/share, and last summer only $4/share.

Many of you may be asking- HOW DID THIS HAPPEN?

We are here to tell you. This GameStop situation is extremely important, in that it points to the nature of how our financial markets have shifted to be affected by culture. First, it is important to note that this all began from a Reddit board. The Reddit board is a conglomeration of traders who are filled with disdain towards the powerful Wall Street folk.

John Authers from Bloomberg wrote, “The people investing today are driven by righteous anger, about generational injustice, about what they see as the corruption and unfairness of the way banks were bailed out in 2008 without having to pay legal penalties later, and about lacerating poverty and inequality.”

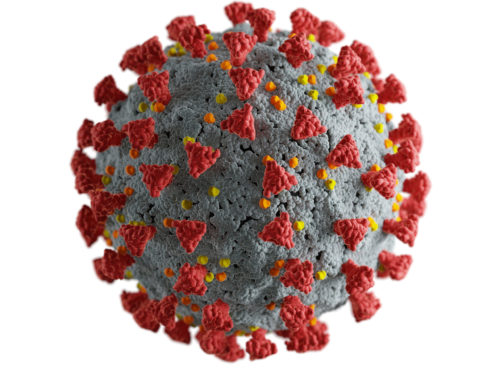

It is important to note the current state of affairs in our country plays a large role in the current stock market circumstances. There is not much else to do during the pandemic, so many traders have taken to the stock market as their only form of entertainment. Of course, it would follow that the sudden uptick of participation in the stock market will lead to sometimes out of the ordinary prices.

It would be wrong to assume one of the greatest explanations of the GameStop saga is Robinhood. Robinhood is a very easy-to-use, practical, and popular app which young investors can trade- for free. With the popularity of the Robinhood app rising, so does the influence of amateur investors on the stock market.

Obviously, those rich Wall Street veterans aren’t thrilled with these inexpert traders influencing their carefully manipulated market. TD Ameritrade and Robinhood are already restricting the purchases of GameStop stock.

Authors, John. “GameStop Short Squeeze Is Rage Against The Financial Machine .” Bloomberg.com, Bloomberg, 26 Jan. 2021, www.bloomberg.com/opinion/articles/2021-01-27/gamestop-short-squeeze-is-rage-against-the-financial-machine.

Kalter Financial Group. AMC and GameStop…What Happened?, 28 Jan. 2021.